Rising Manufacturing Orders Signal Future Economic Growth

Written by:

Rob Santos

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

Compliance Oversight by:

MCO

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

The Institute of Supply Management (ISM) conducts a monthly survey that focuses on the manufacturing industry. The survey asks purchasing and supply managers from over 400 manufacturing companies and 20 different industries (i.e., the individuals who manage their firm’s supply chains) about their business and operations. Survey questions ask about new orders, production levels, employment, inventory, and prices. Investors and economists follow the survey closely because it can provide context about broader economic conditions.

The survey question about new orders asks if orders increased or decreased compared to the prior month. Readings above 50 indicate orders increased, while readings below 50 indicate orders decreased. Why do new orders matter? It’s because purchasing decisions must be made in advance to meet future manufacturing needs. If orders rise and a company expects to increase production, it must buy the required raw materials and other manufacturing inputs months ahead. As a result, rising orders are viewed as a positive for the economy.

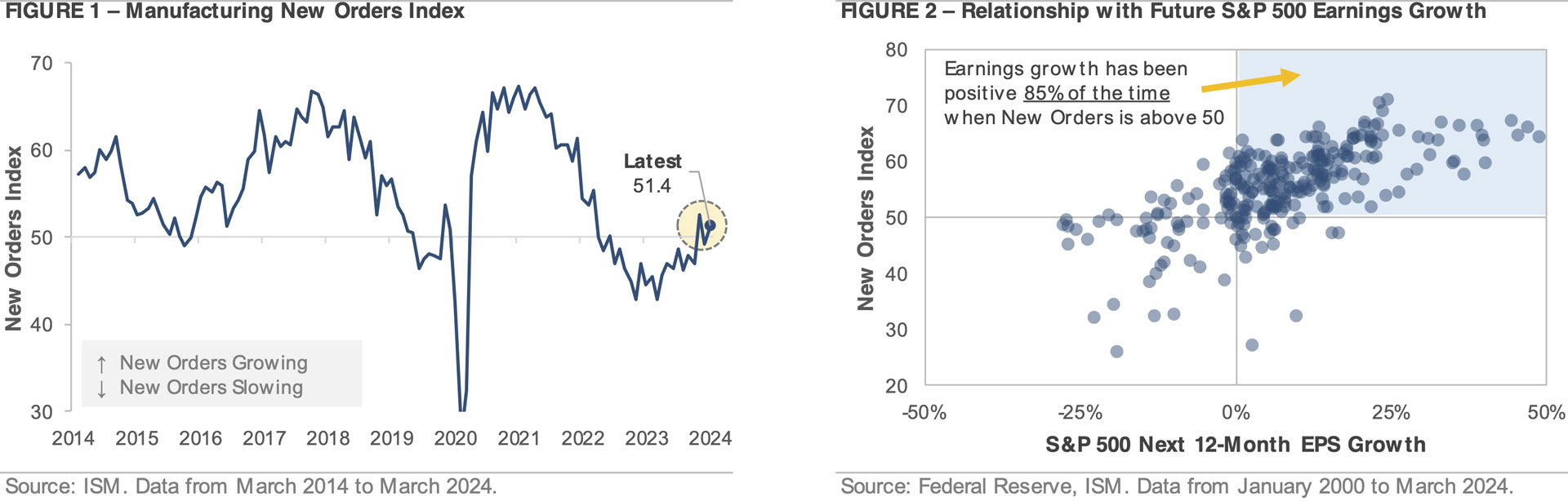

Figure 1 graphs the New Orders sub-index from the ISM survey. The index dropped below 30 as the economy shut down during the pandemic, which signaled a sharp decline in orders. As the economy reopened and manufacturing activity resumed, order activity increased. The New Orders index rose above 50 in June 2020 and remained above 50 until July 2022, which signaled an extended period of rising orders and economic expansion. However, the rate of growth for new orders slowed during 2022 as the Federal Reserve raised interest rates. The New Orders index dropped below 50 in September 2022 and remained below that threshold until December 2023, signaling a slowdown in orders and manufacturing activity.

The far-right side of Figure 1 shows the New Orders index climbed above the key 50 threshold in January 2024, the first time in 16 months. The rise above 50 indicates that manufacturing activity may be starting to expand again, but it also provides insight into corporate earnings. Figure 2 compares the New Orders sub-index against the S&P 500’s year-over-year earnings growth. In general, earnings growth tends to be stronger when the New Orders index is higher. If the New Orders index remains above 50 in expansion, it could be a positive signal for the economy and earnings.

This material contains opinions of the author, but not necessarily those of Arrowroot Family Office LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this material may be reproduced or referred to in any form, without express written permission of Arrowroot Family Office, LLC. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results.

Leave a Reply