The S&P 500’s Concentration Offers a Lesson on Diversification

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

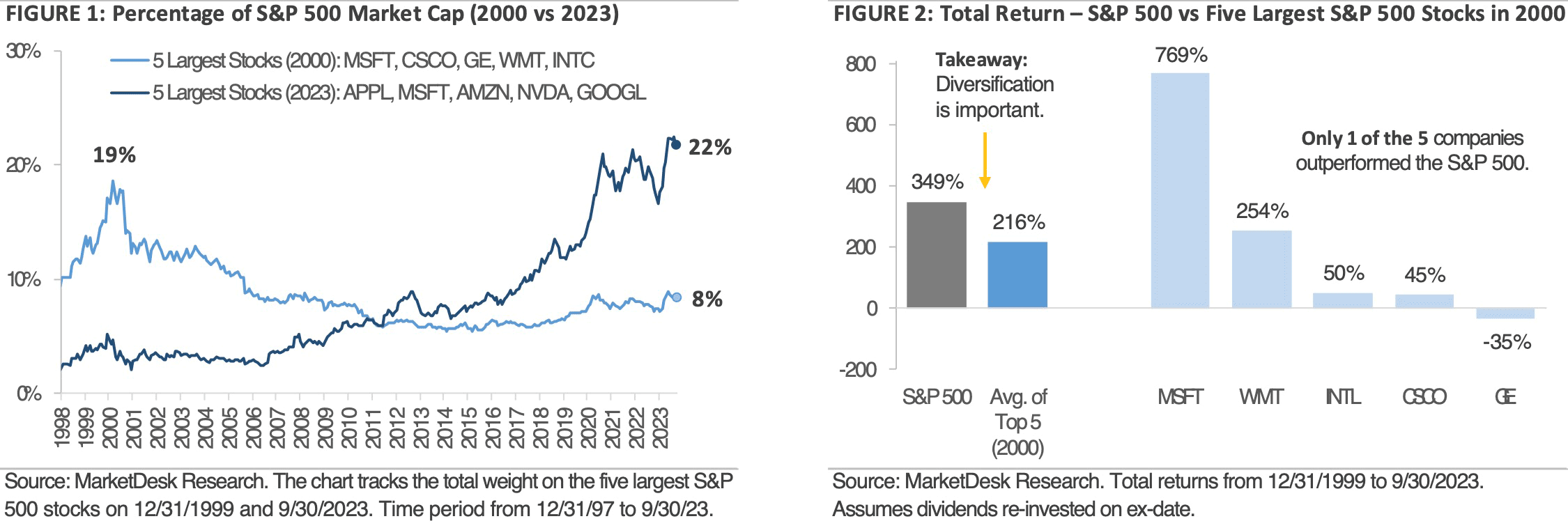

he odds are high that you have read or heard about artificial intelligence or Chat GPT this year. In the stock market, there is a small group of stocks known as the “7 Tech Titans”, which includes leading technology firms exposed to the AI theme. The group of stocks has significantly outperformed this year due to growing excitement about AI, which has in turn increased its weight in the S&P 500. The five largest companies in the S&P 500, which are all part of the 7 Tech Titans, account for 22% of the entire index’s total market capitalization. These five companies include Apple, Microsoft, Amazon, NVIDIA, and Alphabet (the parent company of Google).

The S&P 500 is now highly concentrated, surpassing the previous record set in December 1999. In that era, Microsoft, General Electric, Cisco, Walmart, and Intel collectively represented around 19% of the S&P 500. How have those five stocks fared since 2000? Figure 1 shows their combined weight in the S&P 500 has declined over time, while the weight of today’s five largest stocks has steadily increased. Figure 2 shows the five stocks have produced an average total return of 216% since 2000, compared to the S&P 500’s return of 349%. At an individual stock level, only one out of the five stocks managed to outperform the S&P 500 over the past two decades.

The two charts highlight the importance of diversification. In both instances, the high concentration resulted from the outperformance of a small group of stocks. However, the return data in Figure 2 shows that today’s winners are not necessarily tomorrow’s winners. Diversifying your stock holdings across different sectors and companies can help manage this risk. It’s also important to diversify across bonds, real estate, and other asset classes, as well as regularly rebalance your portfolio to avoid concentration risk like the S&P 500. Financial markets are constantly changing, and owning a portfolio that is diversified across asset classes can help smooth returns over time and decrease overall portfolio risk. Our goal is to help you create a well-balanced investment portfolio that aligns with your financial goals and risk tolerance.

Leave a Reply