S&P 500 Registers its Biggest Monthly Gain Since July 2022

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

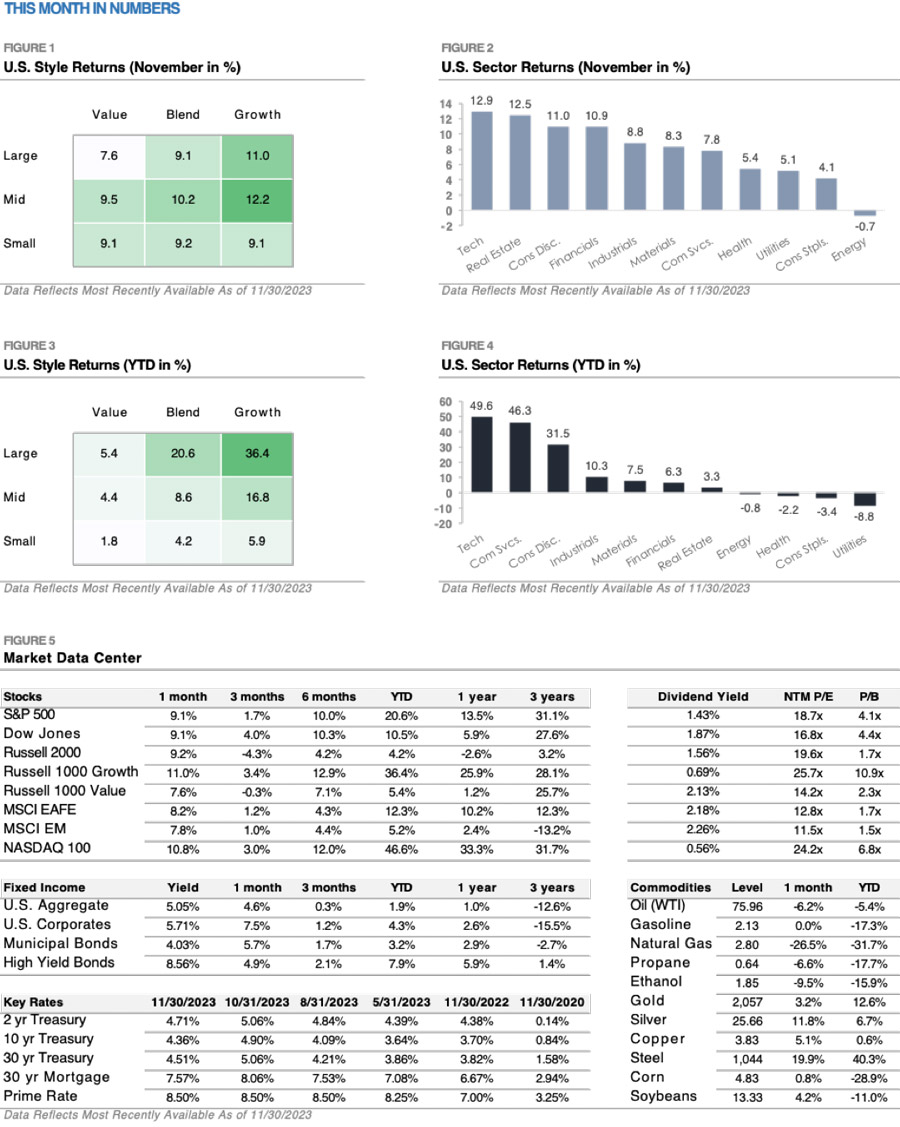

Monthly Market Summary

- The S&P 500 Index gained +9.1% in November, slightly underperforming the Russell 2000 Index’s +9.2% return. Ten of the eleven S&P 500 sectors traded higher, with only Energy trading lower as the price of oil declined -6.2%.

- Corporate investment-grade bonds produced a +7.5% total return as yields declined, outperforming corporate high-yield bonds’ +4.9% total return.

- International stocks underperformed U.S. stocks for a second consecutive month. The MSCI EAFE Index of developed market stocks gained +8.2% and outperformed the MSCI Emerging Market Index’s +7.8% return.

The big story during November was the decline in Treasury yields. The bond market experienced large moves in interest rates, with the 10-year Treasury yield falling to 4.36% from over 5% in October. For context, the -0.54% decline in the 10-year yield ranks among the biggest 1-month drops since December 2008, when the Federal Reserve cut interest rates by -0.75%. Falling Treasury yields provided relief to bonds, which have traded lower as the Federal Reserve hikes rates. The Bloomberg U.S. Bond Aggregate Index, which tracks a broad index of U.S. bonds, produced a +4.6% total return. It was the index’s first gain in seven months and its biggest gain since 1985.

Leave a Reply