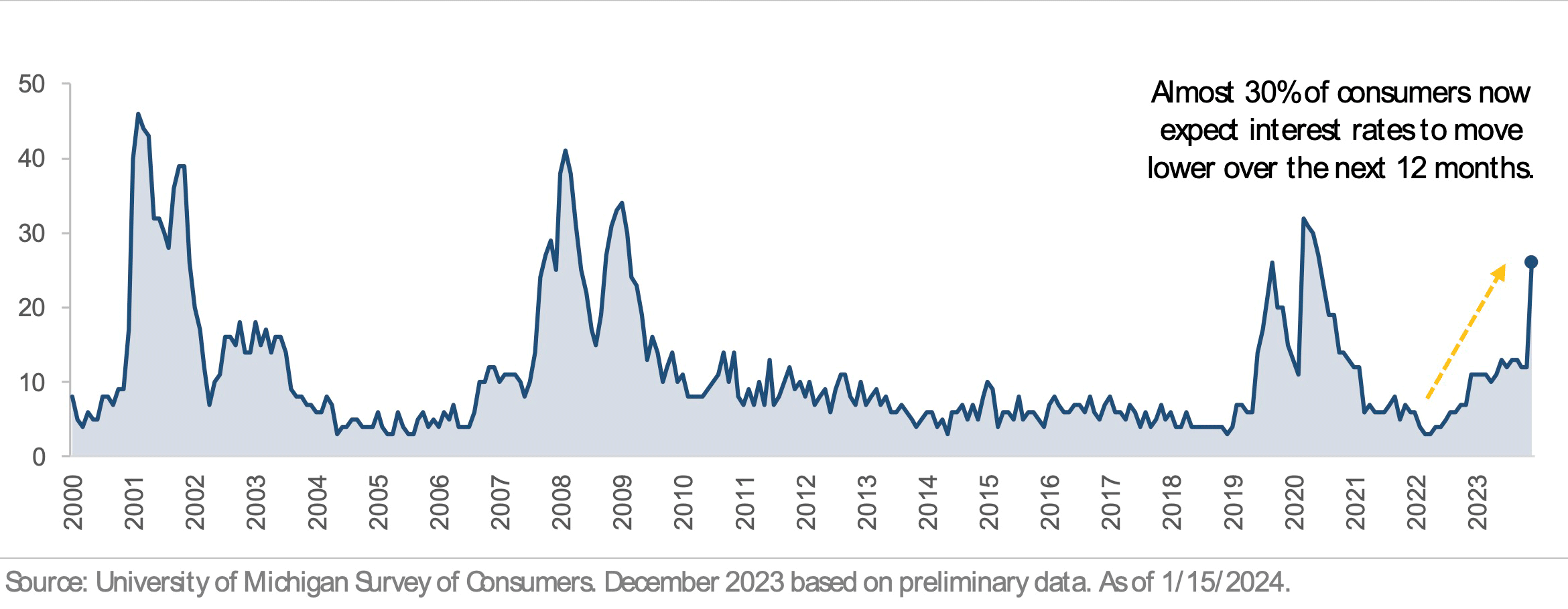

Economic Perspectives: Consumers Start to Expect Lower Interest Rates

Written by:

Rob Santos

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

Compliance Oversight by:

MCO

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

The University of Michigan publishes a monthly Survey of Consumers that assesses the confidence and expectations of U.S. consumers. It asks questions about current economic conditions, expectations for the future, and consumers’ attitudes toward making big purchases. There was a notable development in the December 2023 survey, as the percentage of consumers expecting lower interest rates over the next 12 months rose to nearly 30% from 12% the prior month. This expectation for lower interest rates is connected to easing inflation and the view that there is no need to keep interest rates at current levels with inflation falling back to 2%. Consumers and investors both expect rate cuts in the first half of 2024, and the Federal Reserve is hinting at the potential for rate cuts if inflation continues to ease this year.

This shift in expectations could impact consumer and business behavior. The interest-rate-sensitive segments of the economy that have slowed the most over the past year could start to thaw. As an example, the housing market could pick up if homebuyers believe they can refinance to a lower mortgage rate in the coming years. The combination of lower inflation and lower interest rates could also stimulate overall consumer spending and demand. With financing costs projected to decline, businesses may decide to start a new project, expand operations, or move forward with a project that has been on hold. Overall, lowering interest rates could stimulate demand and help stabilize the economy after the Fed’s aggressive rate hikes.

There are also steps investors can take to prepare for lower interest rates, with the biggest opportunities concentrated in the bond and cash portion of portfolios. Cash and cash-like investments, such as high-yield savings accounts, money market funds, and certificates of deposit (CDs), were big beneficiaries of rising interest rates. Rates on cash jumped to their highest level in years, but those rates could now decline as the Fed starts cutting interest rates. Individuals with excess cash may consider locking in a short-term CD to take advantage of current levels before the Fed starts to cut. Bond portfolios can also be repositioned to lock in today’s yield for an extended period. With interest rates expected to fall from their recent peak, now is a good time for savers to review the fixed income portion of their portfolios.

This material contains opinions of the author, but not necessarily those of Arrowroot Family Office LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this material may be reproduced or referred to in any form, without express written permission of Arrowroot Family Office, LLC. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results.

Leave a Reply