Multiple Stock Market Indices Set New All-Time Highs in January

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

Monthly Market Summary

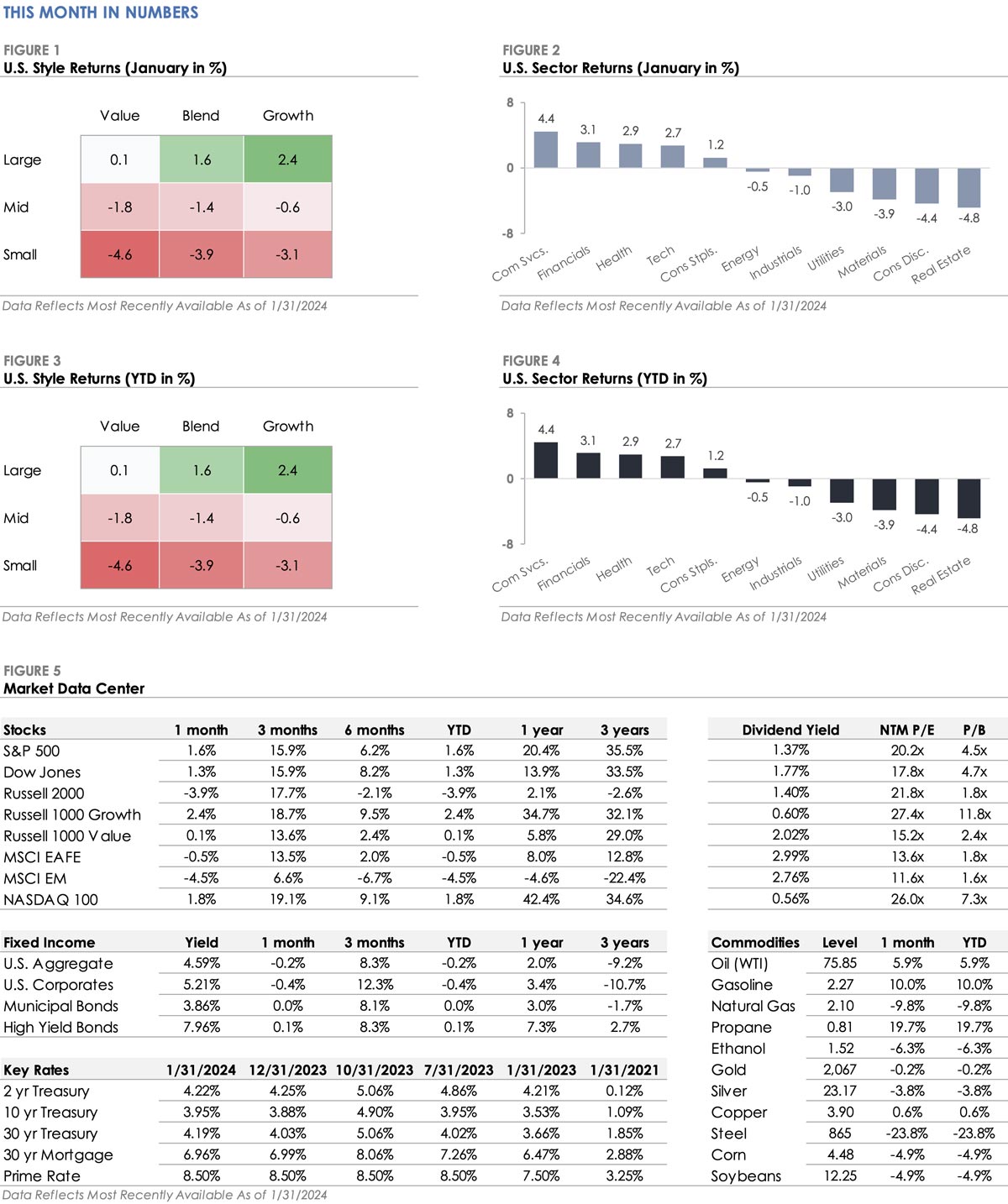

- The S&P 500 Index gained +1.6% in January, while the Russell 2000 Index traded down by -3.9%. Five of the eleven S&P 500 sectors traded higher. Communication Services, Financials, and Health Care each outperformed the S&P 500, while Real Estate, Consumer Discretionary, and Materials traded lower.

- Corporate investment-grade bonds produced a -0.4% total return as Treasury yields rose, slightly underperforming corporate high-yield’s +0.1% total return.

- International stocks traded lower and underperformed U.S. stocks. The MSCI EAFE Index of developed market stocks returned -0.5%, while the MSCI Emerging Market Index traded lower by -4.5%.

Stocks Trade Higher in January, Propelled By Continued Mega-Cap Strength

Federal Reserve Pushes Back the Timeline for Interest Rate Cuts

The Federal Reserve held interest rates steady at its January meeting and hinted that rate hikes are finished for the current tightening cycle. While both actions were expected, the post-meeting statement confused the market. The central bank stated that it wants further confirmation that inflation will return to the 2% target before cutting interest rates. Investors were surprised by the statement after seeing inflationary pressures ease over the past six months and assuming interest rates didn’t need to stay at current levels. What more does the Fed want to see? Fed Chair Powell wasn’t clear, although he reiterated that inflation is moving in the right direction.

The future path of interest rates remains uncertain after the January meeting and press conference. The Fed’s statement provides it with maximum flexibility to adjust monetary policy as needed, cutting rates if inflation continues lower but keeping rates at current levels if inflation proves stickier than expected. What is clear is the Fed’s desire to cut interest rates this year as a proactive measure to support the economy. It’s simply a question of when and by how much the central bank will cut interest rates. Investors and economists have been anxiously awaiting the Fed’s next steps, but it appears they will be waiting for at least a few more months.

Leave a Reply