Key Benefits of Year-End Tax Loss Harvesting

Rob Santos

Chief Executive Officer

As CEO and founder of Arrowroot Family Office, I specialize in the overall management of the firm. I also work with affluent families on providing bespoke family office services, which include tax-efficient advisory and financial planning, M&A advisory, family governance and process advisory, and philanthropic initiatives.

MCO

MyComplianceOffice

A complete compliance management software platform that helps financial services firms unify their activities across conduct and regulatory compliance.

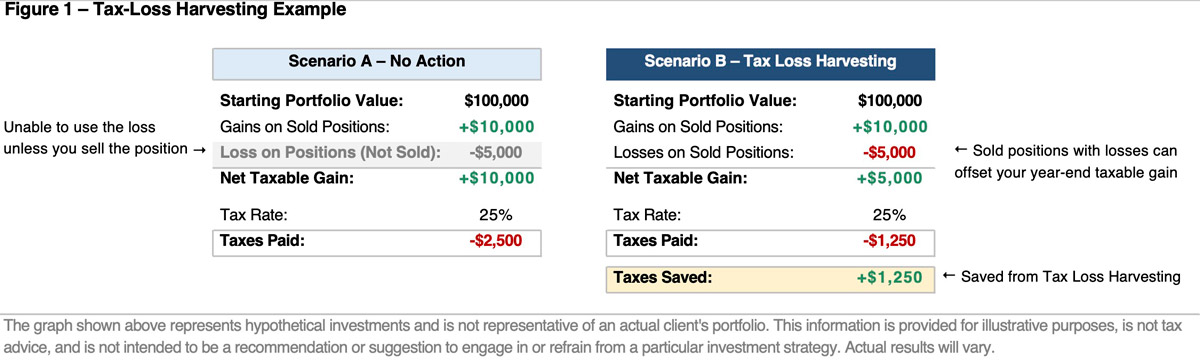

In a perfect world, investors would only see gains when checking their accounts. But in the real world, the stock market can be volatile and doesn’t always trade on a straight upward trajectory. No one wants their investments to decline, but when the market does trade lower, it’s possible to convert those losses into valuable tax assets. This process is called tax-loss harvesting and involves selling underperforming investments to create capital losses, which can offset current-year taxes or be carried forward. This process typically occurs at year-end when investors review their annual portfolio performance and the potential tax implications.

Leave a Reply